DeFi Job Spotlight: Stargate, Cross-Chain Liquidity Reimagined

Key Takeaways

- Stargate is the initial fully composable cross-chain liquidity transfer protocol for native assets with unified liquidity and prompt guaranteed finality.

- Stargate is designed over LayerZero, a novel trustless cross-chain messaging protocol that allows sensible contracts and decentralized purposes dwelling on different blockchains connect with one an additional.

- Stargate is constructed as an open and composable piece of blockchain infrastructure that could be leveraged by other decentralized apps and assignments aiming to go multi-chain.

Share this article

Stargate is a fully composable cross-chain primitive that enables native asset transfers involving blockchain networks with immediately assured finality. It is created on major of LayerZero, a novel piece of omni-chain infrastructure that allows decentralized purposes on diverse blockchains communicate properly and proficiently.

The Condition of Perform in Cross-Chain Liquidity

Stargate is a cross-chain liquidity transfer protocol that lets customers and decentralized applications transfer native belongings concerning chains in a capital-productive way with immediately certain finality.

To realize Stargate’s worth proposition as a novel bridging remedy, it’s to start with needed to reveal how cross-chain liquidity and asset transfers at present function in crypto. These days, end users wanting to make cross-chain asset swaps have two most important selections: off-chain, as a result of centralized exchanges, which introduce regulatory, counterparty, and privacy dangers, or on-chain, via pieces of blockchain infrastructure named bridges.

Blockchain bridges tumble less than two broad types: the first kind relies on a consensus-forming center chain to validate and relay messages throughout blockchain networks, and the 2nd variety runs on an on-chain mild node. The downside of the former tactic is that it makes a solitary issue of failure, risking the liquidity on all chains in the function of a hack or consensus corruption. It also necessitates location chains to trust the center chain, which alone is in no way fully decentralized as it is generally a permissioned chain with a nominal established of validators or is secured by a multi-sig. Even though the latter technique is safe, it’s also expensive, generally costing tens of thousands and thousands of dollars for every working day for each an Ethereum-attached chain.

Bridging or transferring property cross-chain is also in particular challenging simply because of the inherent incompatibility involving blockchains. If a certain token isn’t natively minted or supported on both chains, bridging it from just one chain to a further requires utilizing a “wrapped” or middleman artificial asset. Functionally, this indicates locking up the native token into a sensible deal on the supply chain and then minting a artificial or a wrapped edition of the asset (for case in point, ETH to wETH) on the vacation spot chain.

This approach introduces a perpetual hazard for users holding wrapped property. After all, the good agreement custodying the native assets on the source chain could get hacked and drained of its funds, correctly earning the wrapped tokens worthless simply because people can no lengthier swap them back again for the authentic native assets. This is precisely what occurred with the Ronin bridge hack in March when a North Korean cybercrime syndicate stole in excess of $550 million worth of ETH and USDC in the second-greatest hack in DeFi record. Then, the hackers compromised five validator nodes, received their non-public keys, and stole all the assets held by the bridge agreement, leaving all wrapped ETH on Axie Infinity’s Ronin Community worthless.

Supply: Stargate

The problems in coming up with blockchain bridges stems partly from the so-identified as “Bridging Trilemma,” a theory that states that developers should compromise amongst securing unified liquidity, instantaneous certain finality, and indigenous asset swaps. Unified liquidity delivers shared entry to a one liquidity pool involving various chains, substantially strengthening cross-chain funds effectiveness. Promptly certain finality implies that apps on the spot chain know that a committed transaction will settle at the supply chain, solving the difficulty of transactions reverting owing to a absence of liquidity at the place chain. Ultimately, native asset swap features means that the bridge does not count on insecure artificial or wrapped assets.

Exactly where most bridges today sacrifice indigenous asset swaps in favor of wrapped types, LayerZero Labs, the workforce behind Stargate, says it has solved the Bridging Trilemma by constructing a composable bridging infrastructure that permits for native asset swaps without having sacrificing instant assured finality.

Stargate Defined

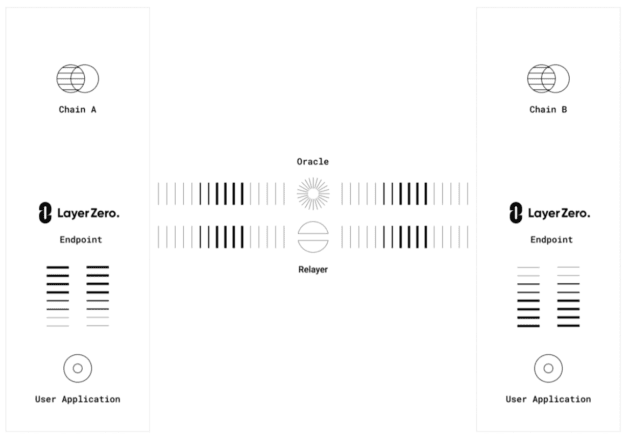

Stargate is a novel, composable cross-chain bridge built as the initially decentralized application above the trustless omni-chain interoperability protocol, LayerZero. It is a user application-configurable omni-chain messaging process that runs an extremely-mild node to deliver the safety of a light-weight node with the cost-performance of middle chains. In straightforward terms, LayerZero has made a cross-chain messaging protocol that allows developers merge the very best of the two worlds in bridge design and style and develop various multi-chain applications—including additional safe and capital-successful bridges—that help native token swaps and are a lot easier to wrap or implement by decentralized programs.

LayerZero Labs has invented a novel useful resource-balancing algorithm dubbed “the Delta Algorithm” that leverages unified cross-chain liquidity to help a new class of cross-chain bridge dealing purely in native assets. Crypto Briefing related with LayerZero Labs co-founder and Main Technology Officer Ryan Zarick to understand a lot more about Stargate, and he started by speaking about how the group was encouraged to launch the challenge. He mentioned:

“Instead of leaving it to 3rd-celebration builders to develop the very first decentralized application and cross-chain bridge leveraging LayerZero, we figured we would do it ourselves. Stargate, like LayerZero, is envisioned to be infrastructure. We want applications like [the decentralized exchange] Sushi to construct on prime of Stargate and allow people to swap any asset with any other asset in a one transaction.”

The Stargate bridge now supports swaps between three stablecoins (USDT, USDC, and BUSD) throughout 7 various blockchain networks (Ethereum, BNB Chain, Avalanche, Polygon, Arbitrum, Optimism, and Fantom). While it can theoretically help all crypto belongings, Stargate focuses on the three most significant stablecoins simply because they are natively accessible on all supported chains and mainly because transferring steady assets is considerably safer than transferring cross-chain. “We needed to keep away from wrapped property,” Zarick reported, conveying that the group thinks they have extra threat. “Every greenback you wrap on a different chain carries a chance that that asset will be de-pegged or missing due to the fact someone can steal the money locked on the supply chain, and now you’re stranded with this asset that’s truly worth zero.”

Stargate’s Novel Options

In addition to indigenous asset swaps and composability, Stargate’s most highly effective aspect might be its cash-economical, unified liquidity swimming pools shared across chains. The unified liquidity feature is very major. For context, to swap USDT from Ethereum to USDC on Polygon, Stargate people deposit USDT in the one USDT liquidity pool on Ethereum and routinely obtain USDC from the single USDC liquidity on Polygon. The Delta Algorithm seamlessly rebalances both equally pools throughout chains in the background so that the deposited and withdrawn amounts are constantly equivalent. The crucial matter in this article is that, instead of every single of the 7 supported chains preserving a separate liquidity pool for each a cross-chain connection for just about every asset, Stargate has a single, unified-liquidity pool for every asset for all connections. Zarick described this position in detail:

“Instead of getting, for instance, a single USDC pool on Ethereum connected only to Avalanche you can have a pool for a solitary asset on 1 chain linked to pools of the identical asset on all other chains. This lets liquidity providers to accumulate charges from men and women relocating belongings on their chain from 7 or extra distinctive chains rather than a solitary one particular. This implies more service fees, which suggests deeper liquidity, which appeals to far more customers and spins the total flywheel all over again.”

As Stargate scales by incorporating a lot more native assets and blockchain network connections, it will have drastically less liquidity pools accruing service fees from at any time-far more cross-chain hyperlinks instead of obtaining at any time-more liquidity pools accruing less costs from a single relationship like standard bridges.

On top of that, Stargate is the 1st and, so far, the only cross-chain composable bridge on the current market, that means that the cross-chain transfers can be composed with equally the smart contracts on the source and the place chain. This presents an unprecedented level of ease for developers and opens up new chances for cross-chain purposes.

As formerly talked about, Stargate is not essentially envisioned to be a person-going through application but a piece of blockchain infrastructure other decentralized purposes could wrap and leverage. For illustration, Sushi’s Stargate integration will let customers swap involving any various token throughout any supported blockchain as long as there’s liquidity for the token on Sushi’s decentralized trade on the desired destination chain. Zarick elaborated on Sushi’s Stargate integration:

“Sushi exists on all these chains, but it’s not connected. So when I want to go concerning two distinctive chains making use of Sushi, I have to leave the dApp and use a different bridge. Perfectly, now Sushi is likely to have this interface the place consumers could just go and say, ‘I have this asset on this chain and want that asset on that chain,’ click swap, wait a few of minutes for the transaction to settle, and which is it.”

Meanwhile, the Reunit omni-chain wallet, which unifies the offered balance throughout all networks, has wrapped Stargate to allow for stablecoin swaps throughout a number of blockchains within a one transaction. For occasion, a consumer could swap USDC on Ethereum for USDT on Avalanche and BUSD on BNB Chain in a single, nearly instantaneous transaction. And if they never have the native property to pay back for gasoline on the location chain, Stargate’s cross-chain composability solves that. “A wonderful amazing function we do,” Zarick states, “is we let you to increase or buy a indigenous token on the spot chain with your LayerZero information. So when you mail, for case in point, USDC to Avalanche, in just the single transaction you can simultaneously obtain a modest volume of AVAX so when you land there you have gas cash and can truly use your funds.”

Eventually, perhaps the past significant function that sets Stargate apart from other bridges is its degree of protection. Stargate employs a novel stability strategy motivated by the 2002 movie Minority Report dubbed “pre-criminal offense.” Initial, by breaking the duties among two distinct parties, the Oracle and the Relayer, the LayerZero protocol that underpins Stargate leverages the protection of recognized oracle service vendors like Chainlink or Band, with the additional protection layer by way of the relayer process.

Since LayerZero is an open protocol, dApps creating on it can opt for their mix of oracles and relayers or operate their possess relayer, getting security into their have fingers. This suggests Stargate can established its own assertions for the messages that get sent by LayerZero and the ones that really don’t. Zarick stated this stage, referencing the principal lead to of the a variety of bridge hacks that have occurred in the past:

“One of the significant problems with bridge hacks is that it’s just about under no circumstances the consensus mechanism but the good contracts that get exploited. So someone exploits the endpoint smart contracts and then sends a message to one more chain and steals the cash. But who delivers the remaining blow? It’s basically that middle chain—it delivers the loss of life blow due to the fact it doesn’t glimpse at the concept.”

To patch this stability challenge, LayerZero Labs arrived up with the strategy of pre-criminal offense. In Stargate’s scenario, it asserts that the textbooks in between the distinct interacting liquidity pools on diverse chains need to be well balanced. In other wards, when another person places $50 on one particular chain and tries to acquire out additional than $50 on an additional chain by exploiting the clever contract, LayerZero only will not supply the concept. This tends to make it a lot harder to exploit the protocol.

Ultimate Views

LayerZero and Stargate have solved quite a few vital challenges that could revolutionize blockchain bridging and propel the multi-chain planet into a new period of interoperability. Right until a short while ago, cross-chain liquidity was usually suboptimal from both a protection and a user-working experience perspective. Stargate tends to make it fast, secure, and economical.

Stargate’s final target, Zarick instructed Crypto Briefing, is for end users to be capable to interact with the protocol devoid of even realizing they are applying it. He claimed that he would like to see Stargate integrate into the back stop of a lot of decentralized purposes, like cross-chain wallets, decentralized exchanges, generate aggregators, blockchain games, and NFT jobs. In small, the goal is to make seamless any-to-any blockchain and any-to-any asset swaps a reality. Stargate has previously executed on building the protocol no matter whether it will see traction with developers and end users stays to be viewed.

Disclosure: At the time of creating, the author of this piece owned ETH, STG, and various other cryptocurrencies.

Share this posting

The information on or accessed through this website is received from unbiased sources we feel to be precise and trustworthy, but Decentral Media, Inc. tends to make no representation or warranty as to the timeliness, completeness, or accuracy of any details on or accessed by way of this web page. Decentral Media, Inc. is not an expenditure advisor. We do not give personalized investment decision guidance or other economical tips. The details on this internet site is issue to modify without having discover. Some or all of the information on this site might turn out to be out-of-date, or it may possibly be or become incomplete or inaccurate. We may well, but are not obligated to, update any outdated, incomplete, or inaccurate details.

You really should under no circumstances make an investment decision conclusion on an ICO, IEO, or other financial commitment centered on the data on this web-site, and you should really never interpret or in any other case depend on any of the info on this internet site as financial investment tips. We strongly endorse that you talk to a certified investment decision advisor or other certified economical expert if you are searching for expenditure information on an ICO, IEO, or other financial commitment. We do not take payment in any form for examining or reporting on any ICO, IEO, cryptocurrency, forex, tokenized revenue, securities, or commodities.

See comprehensive phrases and circumstances.