How inflation truly supports purchaser demand from customers

With home price ranges continuing to defy gravity, mortgage loan costs spiking, the Fed increasing curiosity fees substantially, a yield curve that is just keeping its nose previously mentioned drinking water, and some becoming vocal about the probability that we are going to enter a recession quicker relatively than later, it’s not at all astonishing that numerous of you have been inquiring me regardless of whether the housing market is likely to pull back again substantially, and even a several of you inquiring me whether or not we aren’t in some kind of “bubble” yet again.

And simply because this topic appears to be offering quite a few of you heartburn, I decided that it’s a very good time to reflect on where the housing industry is today and give you my ideas on the affect of mounting mortgage loan rates on what has been a historically very hot marketplace.

As normal, a tiny viewpoint: In between 1990 and the pre-bubble peak in 2006, residence costs rose by 142 percent — which was a very extraordinary once-a-year enhance of 5.6 per cent about a 16 1/2 calendar year time period.

When the sector crashed selling prices dropped by 33 % but from the 2012 low to nowadays, rates have risen by 131 p.c or at an even more rapidly annual level of 8.6 percent over a shorter interval of time, 10 yrs.

You may possibly think that costs climbing at an yearly rate that exceeds the speed witnessed right before the sector crash is what has some brokers and homebuyers involved, but that truly is not what has quite a few people afraid. It is this.

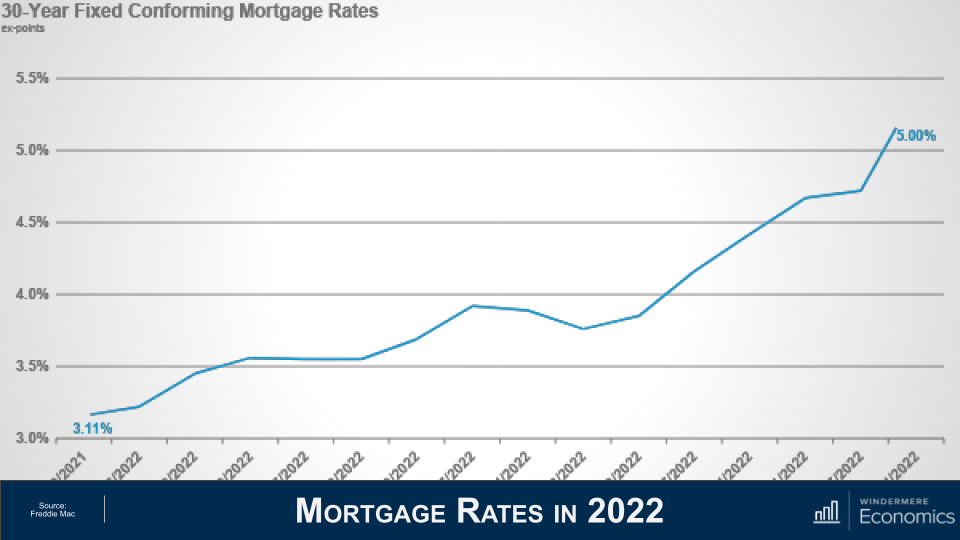

At the begin of 2022, the typical 30-year mounted mortgage amount was just a little higher than 3 per cent but, about a transient 15-7 days interval, they have skyrocketed to 5 per cent and it’s this that has led some to be concerned that the sector is about to implode.

Of training course, no one can say that the runup in residence costs has not been phenomenal about the previous few decades, and it’s certainly human mother nature to assume that “what goes up, ought to come down,” but is there truly any explanation to worry?

I believe not, and to demonstrate my reasoning let’s appear again in time to durations when premiums rose drastically and see how expanding mortgage charges impacted the market.

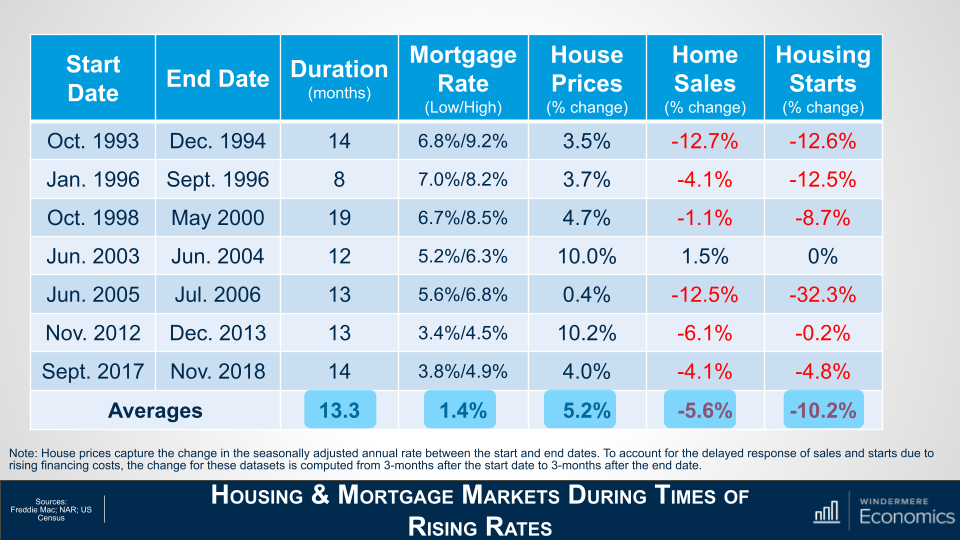

This desk exhibits seven intervals in excess of the previous 30 yrs when mortgage loan prices rose significantly.

On typical, prices trended greater for just around a yr right before pulling again, and the regular increase was 1.4 %.

But now look at how it impacted property prices – it really did not.

On regular, throughout these periods of climbing funding expenses, home price ranges continue to rose by just more than 5 percent. Plainly, not what some might have envisioned.

But there were being some negatives from property finance loan prices trending greater, and these came in the sort of reduced gross sales in all bar one particular period of time as new housing starts off also pulled back again.

So, if background is any indicator, the impact of the latest bounce in mortgage premiums is possible to be observed in the kind of lessen transactions relatively than decrease charges. And this essentially tends to make sense.

Despite the fact that mounting funding fees places further tension on housing affordability what people never show up to think about is that home finance loan rates in fact tend to increase during intervals of economic prosperity and what does a flourishing economic system convey?

That’s proper: growing wages and incomes rising can certainly offset at minimum some of the impacts of soaring house loan rates.

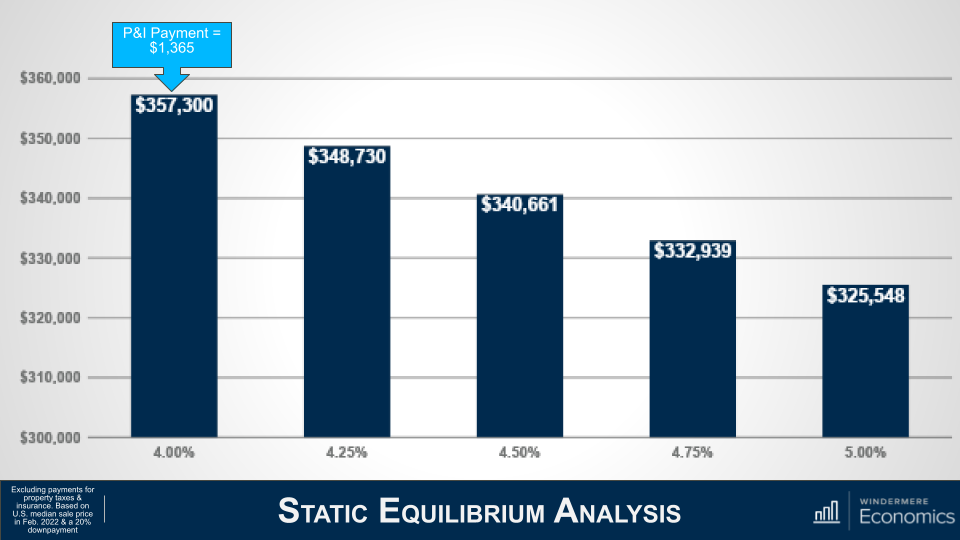

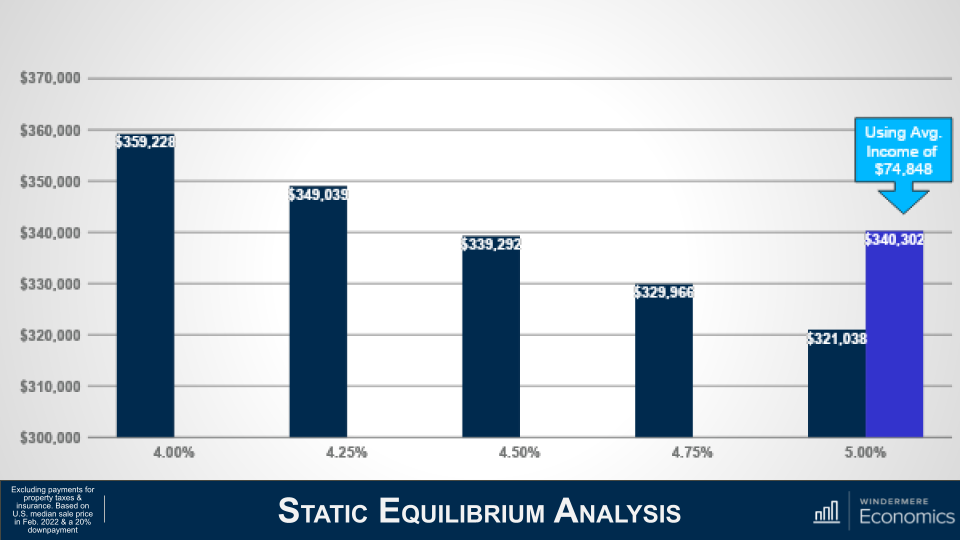

To attempt and reveal this, I’m using the median US sale price in February of this calendar year, assuming a 20 % down payment and the mortgage loan fee of 4 %. And you can see that the every month P&I payment would be $1,365.

But as home loan fees increase, and if buyers desired to maintain the identical every month payment, then they would have to purchase a more cost-effective residence. Working with a fee of 5 p.c, a consumer could pay for a home that was 9 % more cost-effective if they needed to keep the payment the same as it would have been if charges were being however at 4 percent.

But, as I pointed out previously, an growing financial system brings increased wages, and this is staying felt now more than typical offered the employee shortage that exists and companies having to increase payment.

Regular weekly wages have risen by more than 5 1/2 % over the past yr, perfectly previously mentioned the pre-pandemic typical of 2.5 %, and, even though raising incomes would not fully offset soaring home loan prices, it does have an effect.

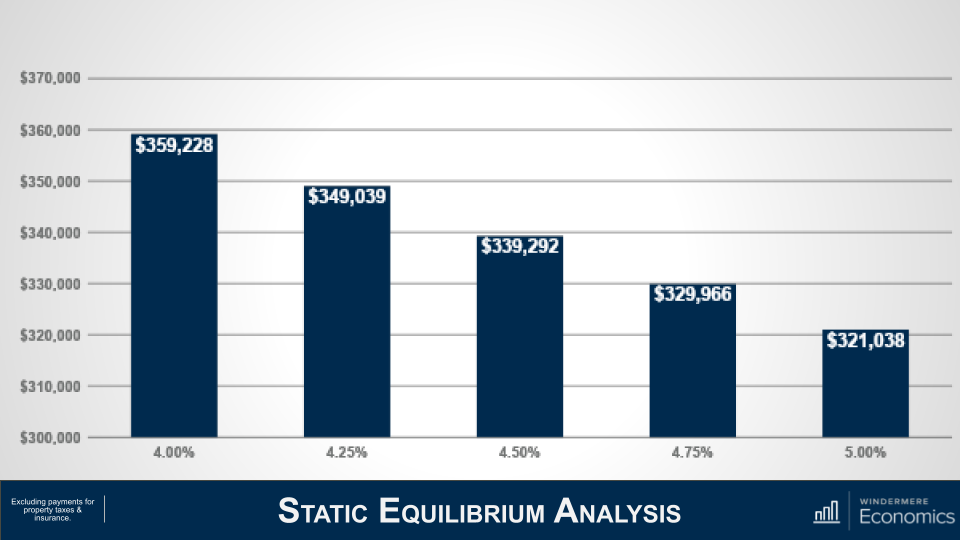

To demonstrate this, let’s use the US average household cash flow of $70,611. Assuming that they’ve set aside 20 percent of their gross money for a down payment, they could find the money for a house priced just under $360,000 if home finance loan costs were at 4 per cent.

As rates increase — and assuming that their revenue doesn’t — their buying electrical power is lessened by around 10 %, or just around $38,000.

But if we feel that incomes will rise, then the image appears to be extremely distinctive. Assuming wages increase by 6 p.c, their acquiring electrical power drops by just 5 % if fees rose from 4 percent to 5 p.c or a little bit considerably less than $19,000.

Even though charges have risen significantly in a quick period mainly because they started off from a historic low, the general impacts are not nonetheless quite sizeable and, if historical past is any indicator, home finance loan premiums raising are probable to have a a lot more significant influence on revenue, but a significantly more compact impression on price ranges.

But there are other components that arrive into engage in much too, and right here I’m speaking about demand.

The only time considering that 1968 that house price ranges have dropped on an annualized basis was in 2007 by means of 2009, and 2011 and this was thanks to a huge maximize in the supply of homes for sale and when provide exceeds need, selling prices dropped.

So how is it different this time around?

Well, we know that the offer glut that we saw commencing to develop in mid-2006 was not just mainly because households have been getting mortgages that, fairly frankly, they need to hardly ever have obtained in the initial position, but a quite huge share held adjustable amount mortgages which, when the preset interest level floated, they located on their own confronted with payments that they could not manage and quite a few possibly mentioned their residences for sale or just walked absent.

Though it’s genuine that in excess of the earlier two or so months, additional customers have started off using ARMs as charges rose, it’s not only a significantly more compact share than we noticed just before the bubble burst, but down payments and credit history quality remained far greater than we noticed again then.

So, if we aren’t faced with a surge of stock I simply just really do not see any purpose why the market will see rates pull back again significantly.

But even if we do see listing action raise, I continue to anticipate that there will be much more than plenty of demand from customers from would-be consumers and I say this for many good reasons, the 1st of which is inflation.

What a great deal of men and women are not chatting about is the demonstrated fact that possessing serious estate is a considerable hedge against rising inflation.

You see, most buyers have a home finance loan, and a extensive the vast majority use preset-price funding and this is the hedge mainly because even as customer charges are growing, a homeowner’s regular payments aren’t. They continue to be static and, additional than that, their regular monthly payments, in serious phrases, truly turn out to be reduced in excess of time as the price of the dollar diminishes. Merely place, the worth of a dollar in, let’s say 2025, will be decreased than the price of a dollar currently.

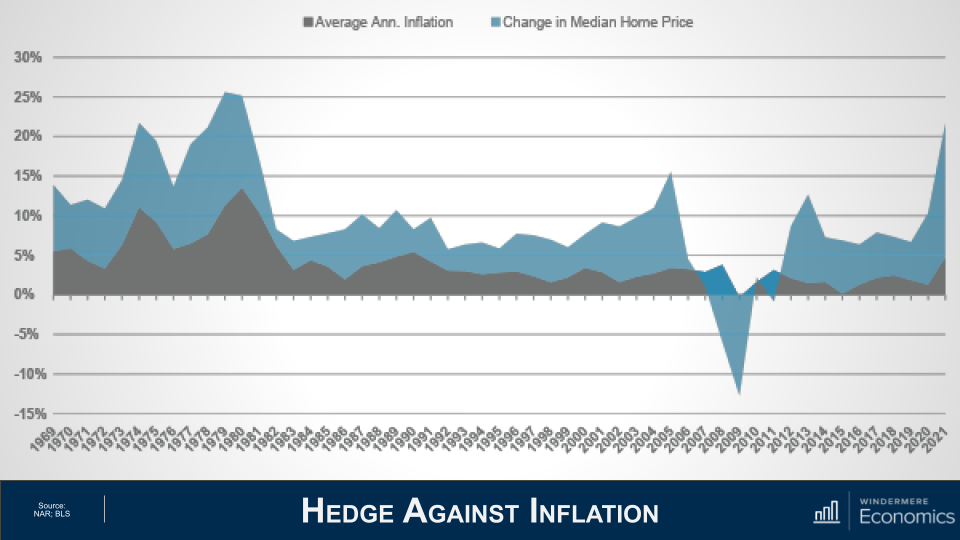

But this is not the only rationale that inflation can basically promote the housing current market. Residence prices — traditionally — increase at a quicker tempo than inflation.

This chart appears at the annual alter in full CPI heading back again to 1969.

Now let us overlay the annual modify in median US property costs above the similar time period.

Other than when residence selling prices crashed with the bursting of the housing bubble, for a lot more than 50 decades, household cost progress has outpaced inflation. This usually means we are offsetting significant customer price ranges mainly because home values are escalating at an even quicker charge.

But inflation has extra impacts on buyers and now I’m conversing about savings.

As we all know, the desire paid on personal savings nowadays is quite abysmal. In simple fact, the most effective dollars market place accounts I could find ended up featuring curiosity rates amongst .5 % and .7 percent. Offered that this is noticeably down below the fee of inflation, it suggests that bucks saved continue on to be truly worth considerably less and significantly less about time when inflation remains sizzling.

Now, instead than observing their revenue drop in worth mainly because of climbing price ranges, it is normal that homes would look to put their money to work by investing in belongings exactly where the return is higher than the fee of inflation. This means that their dollars is no longer shedding value, and where improved to place it than into a dwelling?

So, the bottom line listed here is that inflation supports desire from house potential buyers due to the fact:

- Most are borrowing at a preset charge that will not be impacted by soaring inflation.

- Regular payments are set, and these payments going forward become lower as incomes rise – in contrast to renters out there who continue on to see their every month housing expenses improve.

- With inflation at a amount not observed considering the fact that the early 1980s, borrowers experiencing 5 % mortgage loan prices are nonetheless acquiring an remarkable deal. in reality, by my calculations, mortgage loan premiums would have to split earlier mentioned 7 percent to noticeably gradual need which I locate very not likely.

- If history holds legitimate, property price tag appreciation will proceed to outpace inflation.

Desire seems to continue to be strong, and supply stays anemic. although off the all-time lower stock levels we saw in January, the selection of residences for sale in March was the cheapest of any March given that data begun getting held in the early 1980s.

But even nevertheless I’m not concerned about the effect of rates soaring on the market place in basic, I do worry about 1st-time purchasers.

You see, these are households who have by no means witnessed mortgage charges over 5 % and they just never know how to offer with it. Try to remember that the very last time the 30-yr fastened averaged more than 5 % for a thirty day period was back in March of 2010.

Specified the point that these young would-be homebuyers have not benefited from growing household prices, as existing owners have, as effectively as the actuality that they are faced with soaring rents, making it more challenging for them to help you save up for a down payment on their to start with dwelling, numerous are in a somewhat tight location. It is likely that mounting rates will lower the to start with-time homebuyer share of buys from present-day degrees.

So, the bottom line as considerably as I am worried, is that mortgage loan premiums normalizing should not direct you to feel any form of panic and that current rates are really not likely to be the lead to of a market correction.

If you concur with me that a systemic fall in property selling prices has to be induced by a significant maximize in offer, and that purchasers who are currently having out adjustable-rate mortgages are extra experienced, and consequently capable to control to refinance their households when rates do revert at some level in the potential, then what will bring about listings to increase to a place that can negatively effects price ranges?

It’s correct that a sizeable increase in new residence development may well cause this, but that is unlikely.

And as far as current homeowners are anxious, I stress far far more about a extended deficiency of stock than a considerable maximize in properties for sale and I say this for 1 very straightforward explanation. It is due to the fact a vast the vast majority of householders both acquired when home finance loan charges were being at or near their historic lows or refinanced their present-day houses when rates dropped.

It’s this that could be the major difficulty for the marketplace. Even if premiums really do not increase at all from existing levels, I dilemma how numerous entrepreneurs would consider about providing if they had been to shed the historically reduced home finance loan rates that they have locked into.

It is pretty feasible that for this one purpose, we might knowledge a restricted housing market for several much more many years.

To get the large image together with all of the data, view the complete video earlier mentioned.

Matthew Gardner is the chief economist for Windermere Actual Estate, the next biggest regional actual estate organization in the country.