PriceVol’s pulse on the market

primeimages/iStock via Getty Images

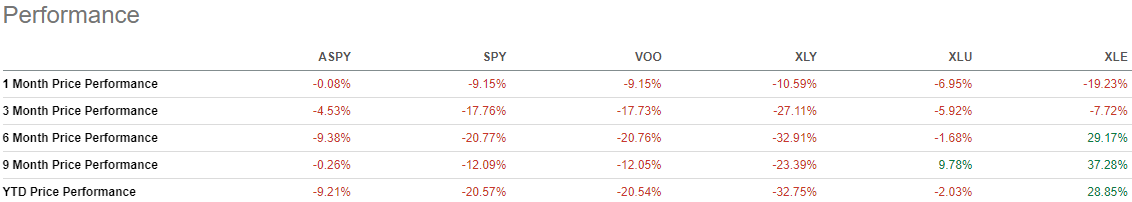

Market volatility ticked slightly lower this week according to PriceVol, a branded risk indicator created by ASYMmetric ETFs. PriceVol topped out at 7.7 on Thursday and had an average daily data point of 7.1, which was lower than the average of the previous week’s 7.3 figure.

PriceVol is an instrument intended to measure market volatility of 100% of the S&P 500 delivering investors a more complete view of volatility compared to the traditional measurements provided by the CBOE Volatility Index (VIX). See more information on PriceVol.

Where was volatility seen?

General volatility eased slightly across the S&P 500 monitoring ETFs like the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) and Vanguard 500 Index Fund (NYSEARCA:VOO). But certain sectors still noticed higher areas of realized volatility compared to others.

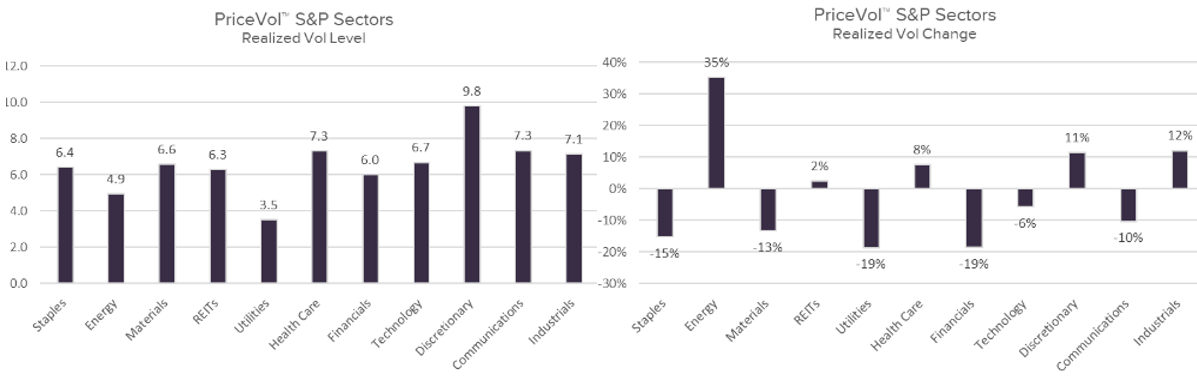

The segment of the market that noticed the highest level of volatility for the week was once again the Consumer Discretionary (XLY) sector. Consumer Discretionary registered a realized volatility level of 9.8, a full point higher than the previous week’s 8.8. On the other end of the spectrum Utilities (XLU) felt the lowest levels of volatility at 3.5.

Examining rate of change, and investors will have realized that Energy (NYSEARCA:XLE) saw the most significant volatility spike as the sector watched levels rise by 35% to 4.9. Below is a visual representation:

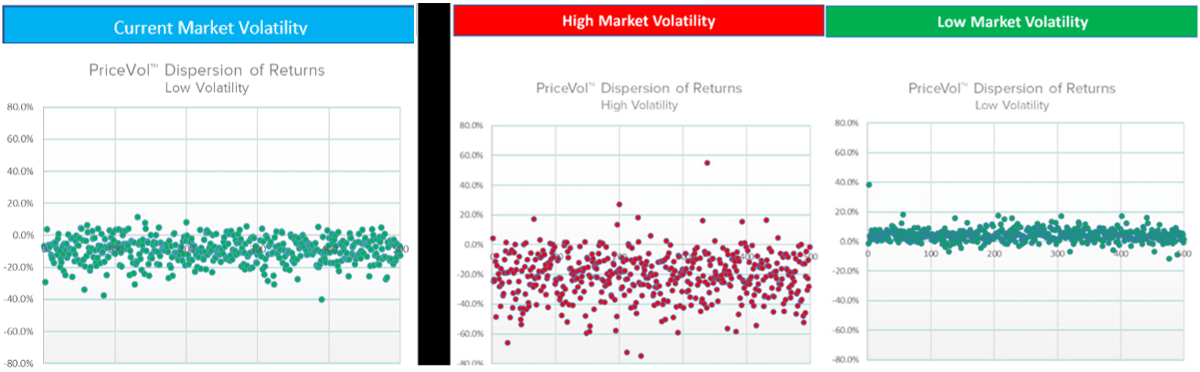

The dispersion of volatility is an important aspect to how it is inferred. With that being said below is a chart of the current state of market volatility through the lens of PriceVol along with what a traditional dispersion of high and low volatility situations would appear like.

ASYMmetric S&P 500 ETF (NYSEARCA:ASPY) is a fund that was produced from the PriceVol indicator. Moreover, ASPY is a quantitative long/short hedging strategy that aims to deliver investors a backstop against bear market selloffs by being net short, while also seeks to capture the majority of bull market gains, by being net long. See below the performances of all five ETFs discussed across multiple time frames along with the complete PriceVol data from the previous week.