Which Dividend Aristocrats Are the Most Engaging?

Dividend Aristocrats are excellent sites to be when the industry waters get really tough. Even though they continue to get knocked down throughout bear markets, their dividends tend to offer a glimmer of certainty amid turbulent times.

The payouts of Dividend Aristocrats have held up for the duration of earlier crashes, crises, and every little thing in amongst. With escalating dread that we will fall into a bear market place and recession, insisting on high quality may well confirm a clever conclusion.

In this piece, we utilized TipRanks’ Comparison Device to evaluate a few of the most attractive Dividend Aristocrats that have outpaced the broader S&P 500 on a year-to-day foundation.

Chevron (CVX)

Chevron is a large oil firm that Warren Buffett has been loading up lately. Subsequent the Oracle of Omaha’s most current aiding, Chevron is now a best-four keeping in Berkshire Hathaway’s portfolio.

Year-to-date, shares of Chevron are up in excess of 40%, considerably higher than the S&P 500, which is down close to 18%. With the stock fluctuating at close to $165 per share, the stock could be at risk of a pullback if the broader marketplaces are capable to obtain their footing.

In any scenario, the actuality of higher oil price ranges would seem to be sinking in for quite a few. With Russia’s invasion of Ukraine, $100 per barrel of oil may be listed here to remain. If that’s the situation, Chevron will be prosperous with dollars move about the upcoming 18 months.

However it is really hard to chase a inventory that’s currently taken off, it can be value noting that the valuation is nonetheless extremely inexpensive. The inventory trades at just 15.12 moments trailing earnings, with a 3.5% dividend generate. It can be not a mystery why Buffett likes the large oil business. Energy stocks are one particular of the couple locations to hide from broader volatility, and Chevron is arguably one of the most effective of the bunch.

With a healthier harmony sheet and leading-tier output progress, Chevron appears to be one particular of the Dividend Aristocrats that can hold powering bigger, even in the encounter of a recession.

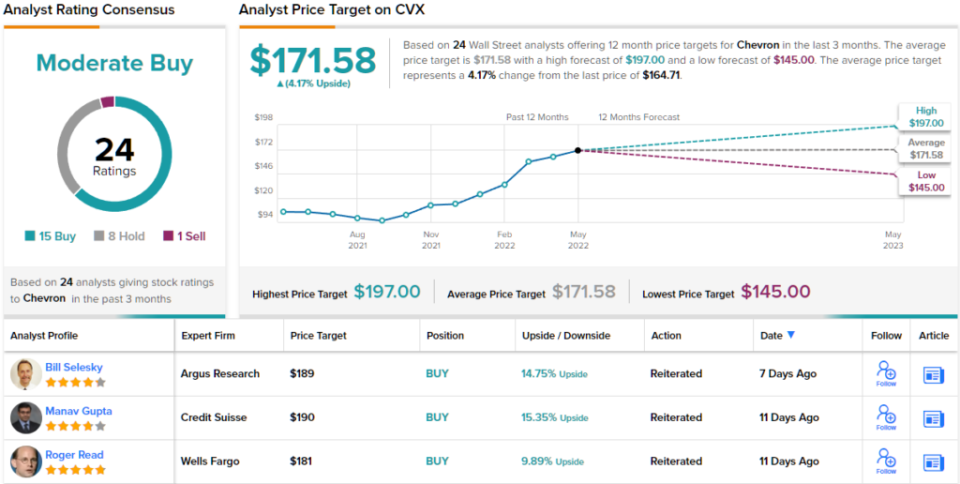

General, CVX retains a Average Acquire ranking from the analyst consensus look at, dependent on 15 Purchases, 8 Holds and 1 Offer. The stock’s $171.58 common cost goal indicates place for only 4% upside from the present share price of $164.71. (See CVX stock forecast on TipRanks)

Story proceeds

Global Business Equipment (IBM)

IBM is an outdated-time technologies organization which is also held its have fairly nicely amid the marketplace correction. Shares of IBM are up 2% yr-to-date. While IBM’s ground breaking capabilities might be matter to scrutiny, there is no denying the price and dividend yield—currently at 5.1%—to be had in the name.

It truly is been years because Berkshire Hathaway has thrown in the towel on IBM. Although the very low valuation metrics and higher produce were being current, the inventory experienced ongoing to be a perennial underachiever – and it carries on to be to this day. Shares are even now down from their 2013 highs, even when adjusting for dividends. It is been all over nine a long time, and the inventory has nevertheless still to get well.

Relocating ahead, there are factors for optimism. The company’s margin-dampening Kyndryl small business has been spun off, and it could pave the way for margin expansion.

Even though IBM’s most up-to-date 1st-quarter effects defeat by two pennies, management’s direction was really encouraging. However, it will be complicated for the company to maintain a rally if an financial economic downturn is approaching.

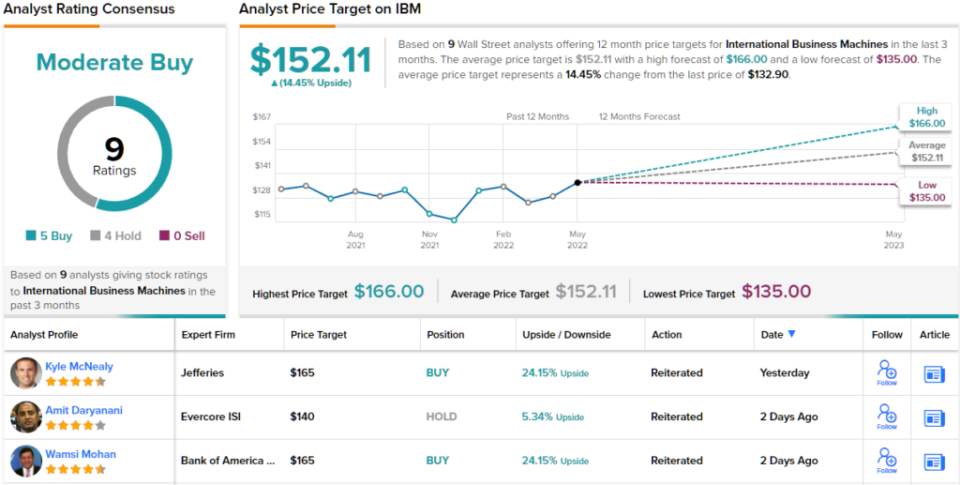

Wanting to Wall Road, analysts are bullish, with the regular IBM price focus on of $152.11 implying 14.45% upside from present-day levels. (See IBM stock forecast on TipRanks)

Johnson & Johnson (JNJ)

Johnson & Johnson is a further Dividend Aristocrat that’s truly up ~5% year-to-day. The health care behemoth a short while ago came off a modest earnings beat ($2.67 compared to the $2.56 consensus) inspite of ongoing supply chain issues.

The Oncology segment saw 15% sales advancement, led by Darzalex and Erleada. Seeking in advance, the organization expects Pharmaceutical revenues to be close to $60 billion by 2025. The formidable focus on is practical and would gasoline more dividend increases for investors, regardless of the place the financial system heads next.

With negligible publicity to Ukraine and Russia, Johnson & Johnson has been minimally impacted by the Russia-Ukraine war. As a health care engage in, the company is also a wonderful defensive for recessionary situations.

At writing, the inventory trades at 23.8 periods trailing earnings and about 5 situations gross sales. With a mere .72 beta, JNJ inventory is nevertheless an additional Dividend Aristocrat that really should proceed outperforming the averages amid a downturn.

The 2.55% dividend yield is modest, but it is very protected and topic to development in excess of the many years as the enterprise looks to satisfy its 2025 top-line targets with or without a economic downturn.

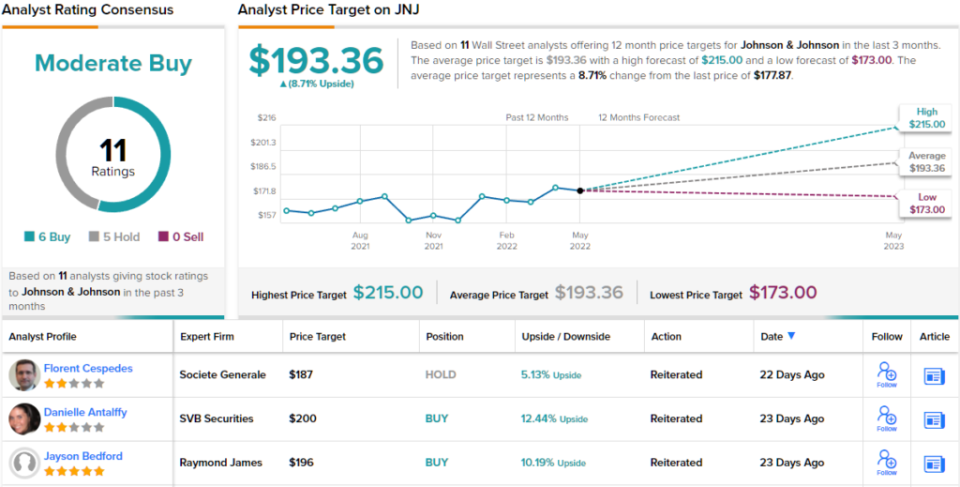

Turning to the analyst neighborhood, opinions are split virtually evenly. 6 Buys and 5 Retains add up to a Reasonable Buy consensus score. At $193.36, the ordinary price tag target implies ~9% upside potential. (See JNJ inventory forecast on TipRanks)

Conclusion

Dividend Aristocrats might incredibly properly be just one of the greatest spots to outpace the S&P 500 in a pretty hideous 2022. So significantly, they have fared effectively. Strong fundamentals really should pave the way for additional of the similar. At the moment, IBM stock has the highest implied upside opportunity at ~14%, even though Chevron has the lowest at ~4%.

To locate fantastic concepts for dividend stocks investing at attractive valuations, take a look at TipRanks’ Greatest Shares to Invest in, a newly released device that unites all of TipRanks’ fairness insights.

Study entire Disclaimer & Disclosure